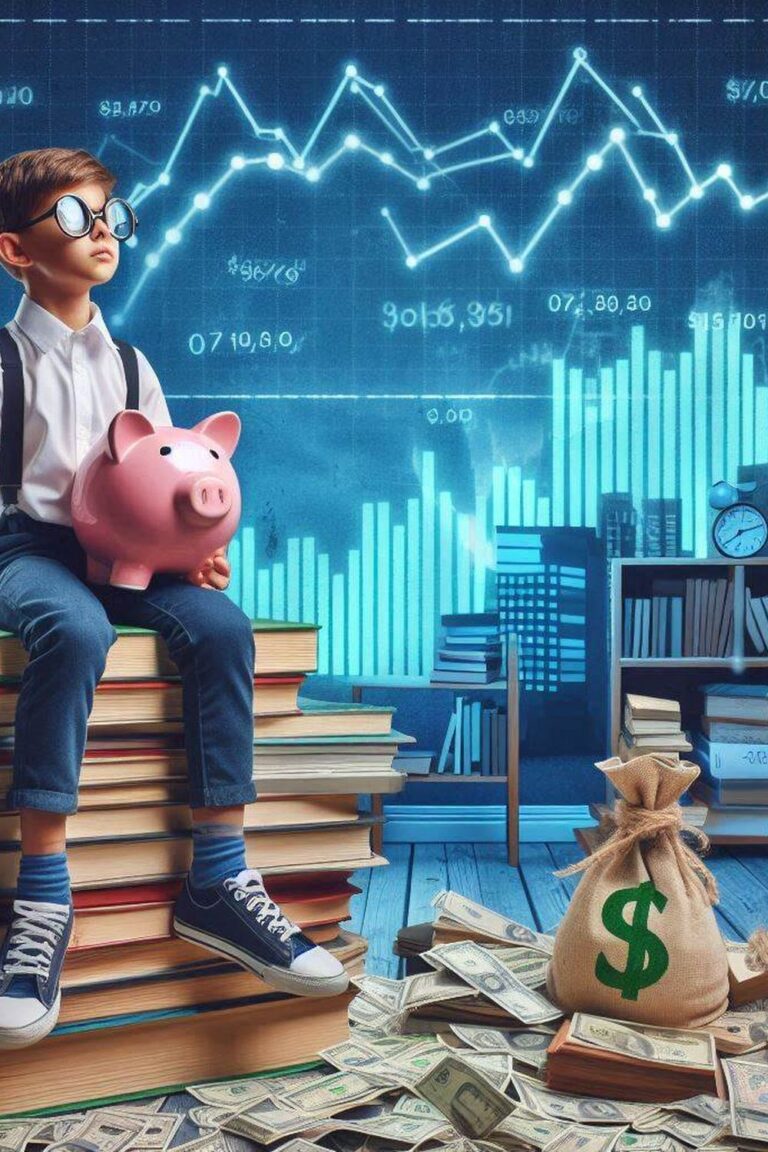

Reducing superfluous expenses is fundamental to improve your financial health. We could say that it is, in fact, an unavoidable task. Therefore, take some serious time to identify and eliminate those expenses that are not really essential, those that are obsolete or dispensable, or those that clearly do not contribute to your financial goals.

Start by reviewing your monthly expenses and analyzing where you can cut back. This may include cancelling unused subscriptions, reducing spending on entertainment or eating out, or you may also look for cheaper alternatives to the usual products and services.

It is important to prioritize your needs over your wants, and even more so over your whims until you are in a position to afford them effortlessly, and you should always be very aware of your consumer profile and spending habits.

Consider setting a fixed and immovable monthly budget, assigning specific amounts for each spending category and sticking to them. Use the help of expense tracking tools to classify and review your spending habits and analyze that information to make adjustments as needed.

By reducing wasteful spending, you can increase your ability to save and move closer to your financial goals. You must take a proactive approach to be successful and learn to identify savings opportunities. In the meantime, look for creative ways to reduce your expenses without sacrificing your quality of life.

Remember that every small adjustment you make can make a big difference in the long run. Don’t lose sight of your ultimate goals and celebrate every accomplishment along the way to better managing your personal finances.