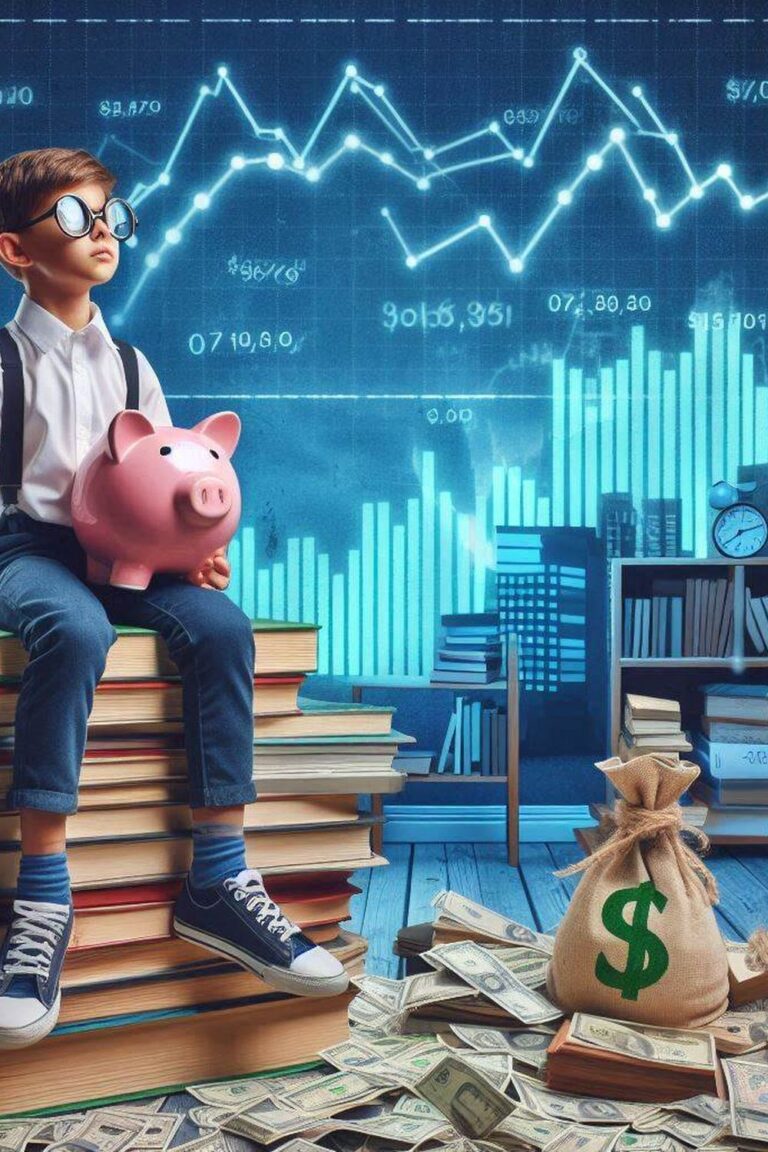

Setting clear financial goals is much more important than it might seem. You must define your goals in a specific, numerical, concrete and unambiguous way, regardless of the size of those goals or the deadline you have set for achieving them.

When we talk about specific and concrete goals, we are referring to quantifiable things, such as saving for an emergency fund of a certain size, or paying off debts of a known amount.

Divide your goals into achievable time frames, such as and classify them into short, medium and long term. For example, you could set a short-term goal to save a percentage of your income each month, a medium-term goal to pay off a specific debt within a certain time frame, and a long-term goal to achieve financial freedom in a number of years.

By setting clear and concrete financial goals, your mind will provide you with a clear roadmap for financial success, and help you open the paths necessary to achieve them. Concreteness gives you a clear purpose and motivates you to take concrete steps to achieve your goals in the time frame you set. It also allows you to stay focused and measure your progress over time. This focus helps you make adjustments as needed and celebrate your accomplishments along the way.

To set effective financial goals, make sure they are specific, measurable, attainable, relevant and time-bound (known as the acronym SMART). For example, instead of saying “I want to save money,” set a SMART goal such as “I want to save $500 a month for the next six months to build an emergency fund.” These types of goals give you clear guidance on what you are trying to accomplish and help you maintain the discipline necessary to reach your financial goals.

The ultimate trick we can offer you is to put those goals in writing and keep them in a visible place where you can review them often and feed back to your will and your mind to keep them aligned in their achievement.