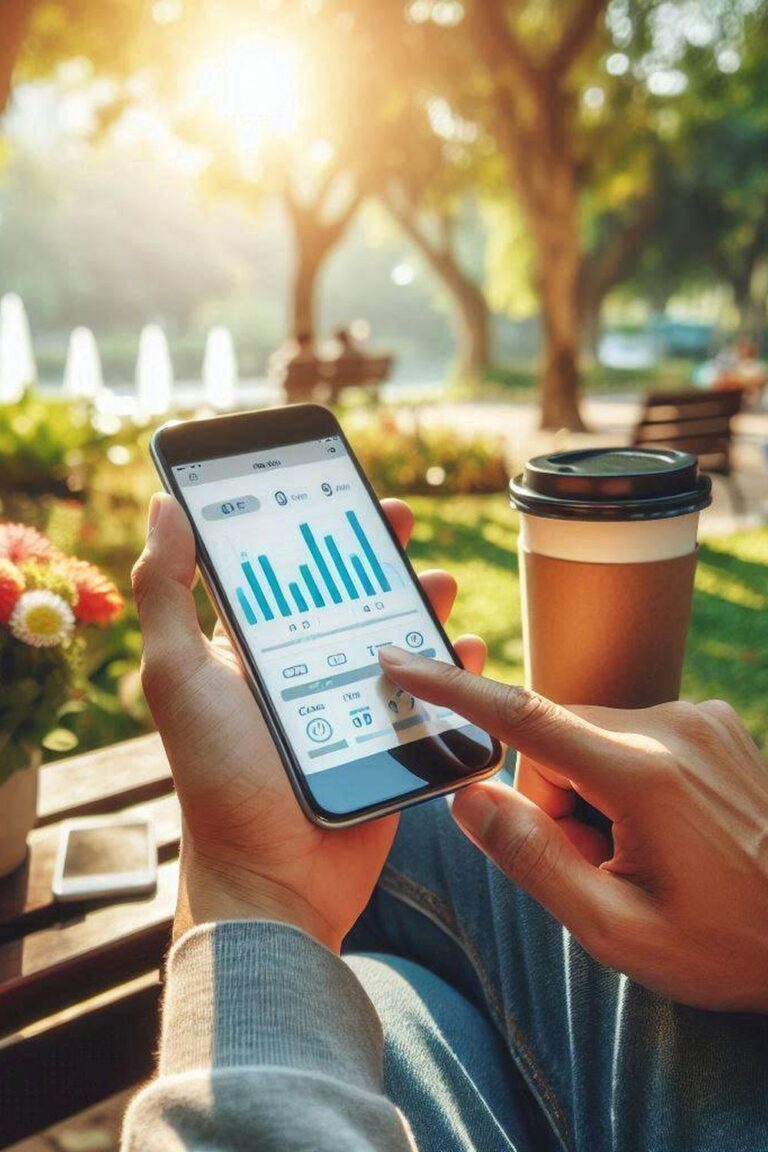

The truth is that everything that is financial management, can be carried out effectively simply with paper and pencil, without complications. But it is no less true that the financial management applications we have today are powerful tools that greatly facilitate the control of income, expenses and savings, and if we learn to use them, they will really make our lives easier.

There are multiple applications on the market, and among the most famous are Mint, YNAB and PocketGuard, to give just three examples. But in general all of them allow you to have a clear view of your financial situation at any time.

Among their many functions, these applications help you create budgets, categorize transactions and set savings goals. In addition, many of them offer alerts and reminders to avoid overspending, dates of a payment, and ultimately serve as support and guidance to keep you on track and have reliable information.

Evaluate these digital tools seriously and carefully, because if you use them, they will facilitate the monitoring of your financial progress and will also serve as motivation to continue improving your economic habits.

With the right application, managing your finances will be easier and more efficient. If you don’t like them, you can always continue to manage your finances with a spreadsheet or pen and paper, but the truth is that their advantages are undeniable.