If you are up to your ears in debt, you should regularly monitor your financial situation. Otherwise, you will find it much more difficult to get out of the debts that are weighing you down and to reach your financial goals. Take time periodically to review your income, expenses, debts and savings.

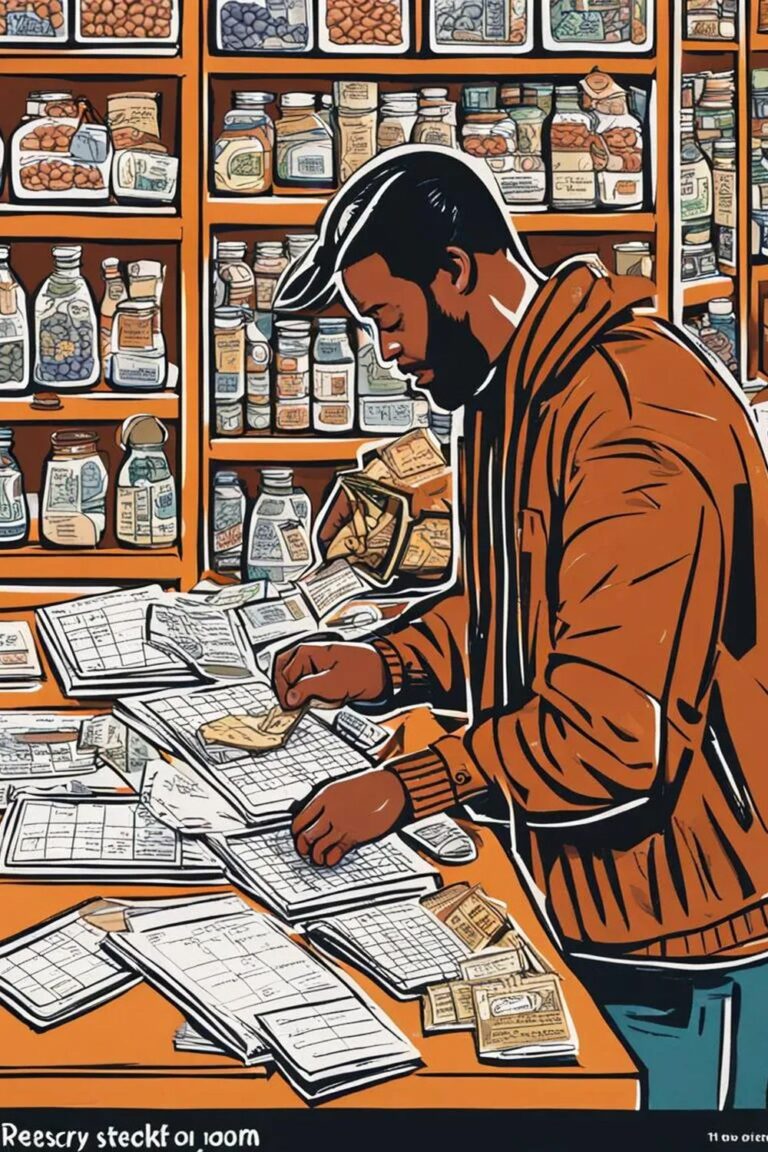

Carefully analyze your bank statements, bills and credit card records to better understand your current financial situation and envision strategies of attack, because you will be able to identify spending patterns, areas of waste and savings opportunities.

Use tools such as spreadsheets, mobile apps or financial management software to keep your records organized and easy to understand. Do whatever it takes to simplify everything as much as possible in your mind. Once done, adjust your financial plan as needed and set realistic goals that you can achieve and that will serve as both a positive anchor and willpower booster.

Keeping good track of your financial situation puts you in full control of your finances and will help you improve your long-term financial well-being. Don’t underestimate the importance of this habit and take time regularly to review and adjust your financial plan according to your needs and goals. Be realistic, and be honest with yourself.